Gifts of Appreciated Securities

A Tax-Savvy Way to Benefit from Growing Assets

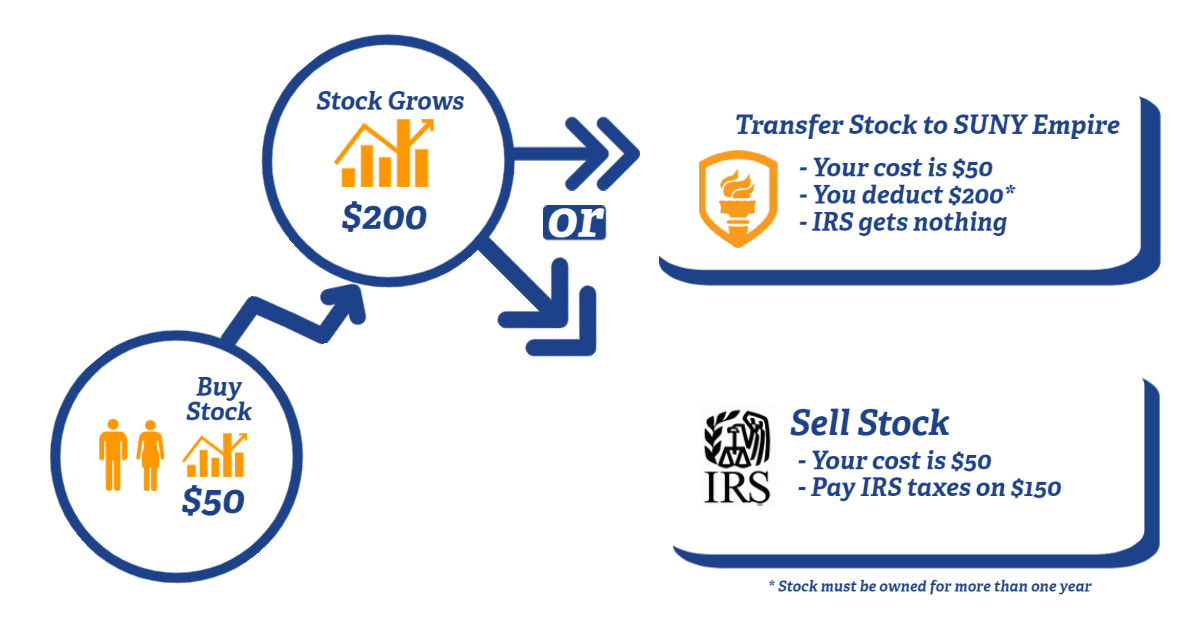

Gifts of appreciated securities including stocks can be one of the most advantageous ways of giving. By transferring these assets directly to SUNY Empire State University you may be able to deduct the full fair market value and bypass all capital gains taxes.

Securities and mutual funds that have increased in value and been held for more than one year are popular assets to use when making a gift to SUNY Empire. Making a gift of securities or mutual funds offers you the chance to support our work while realizing important benefits for yourself.

When you donate appreciated securities or mutual funds in support of our mission, you receive the same income tax savings that you would if you wrote a check, but with the added benefit of eliminating capital gains taxes on the transfer, which can be as high as 20 percent. To have your gift count toward the 2023 calendar year for tax purposes, a transfer to the SUNY Empire State College Foundation’s brokers must be received by 12/31/23.

To initiate your transfer today using our online tool, click on the button below. If you have questions or would like instructions on how to complete a transfer, contact Toby Tobrocke, Director of Development at Toby.Tobrocke@sunyempire.edu or at 518.281.2892.